option to tax form

Complete the required boxes these are yellow-colored. Tell HMRC about an option to tax land and buildings.

Blue Summit Supplies Tax Forms 1099 Misc 4 Part Tax Forms Bundle With Software And Self Seal Envelopes 25 Count

VAT1614B ceasing to be a relevant associate in relation to an option to tax.

. Form Disapply the option to tax land sold to housing associations. A typed drawn or uploaded. Use this form only to notify your decision to opt to tax land andor buildings.

Refer to Publication 525 for specific details on the type of stock option as well as rules for when income is reported and how income is reported for income tax purposes. Pick the document template you will need from our collection of legal form samples. Stock options vs equity differ in many ways.

These two types of investments can be granted to employees in a startup company as a form of the employee compensation plan. These are generally options contracts given to employees as a form of compensation. VAT1614C revoking an option to tax six-month cooling.

Before you complete this form it is strongly recommended that you read Notice 742A Opting to tax land and buildings available from our website go to wwwhmrcgovuk A paper copy and general guidance are available from our advice service on 0845 010 9000. This means changing an exempt supply which you wont be able to recover VAT on into a taxable supply so VAT can be gained. Ad Fast and Easy IRS Form 2290 Heavy Vehicle Use Tax HVUT Online Filing.

Before you complete this form it is strongly recommended that you read Notice 742A Opting to tax land and buildings available from our website go to wwwhmrcgovuk A paper copy and general guidance are available from our advice service on 0845 010 9000. Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422b. Refund filers use Form 10IE to declare their preference for the Modern Taxation System.

Filing a paper tax return. Form for Notification of an option to tax Opting to tax land and buildings on the web. To complete the loop there are three other forms that are used in limited situations which are mainly relevant to entities with a large portfolio of properties.

Get Schedule 1 in Minutes. 8 October 2014 Form Apply for permission to opt to tax land or buildings. For example incentive stock options.

To get started on the form use the Fill camp. Its a common issue for ambitious startups to want to draw in top talent to advance their company but they frequently lack the funds to offer top salaries. VAT 1614A Opting to tax land and buildings Notification of an option to tax Subject.

Click the Get form key to open the document and begin editing. This form will report important dates and values. Sign Online button or tick the preview image of the form.

This article talks about the option available to choose a new taxation slab under Form 10E with some frequently asked questions to clarify the matter. Options contracts on equities that can be traded on the open market. In the Finance Act of 2020 the Ministry Of finance created a Modern Taxation System.

Decide on what kind of signature to create. The vast majority of businesses dont need or choose to tax their trading premises. The advanced tools of the editor will guide you through.

10 June 2022 Form Revoke an option to. Filing an electronic tax return often called electronic filing or e-filing or. If they subsequently sell back the option when Company XYZ drops to 40 in September 2020 they.

Apply for permission to opt to tax land or buildings. Select the document you want to sign and click Upload. The main reason a supplier would choose an option to tax is to recover VAT on associated costs.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Taylor purchases an October 2020 put option on Company XYZ with a 50 strike in May 2020 for 3. Claim The Money You Deserve.

Opt to tax land andor buildings. Execute OPTION TO TAX LAND ANDOR BUILDINGS NOTIFICATION FORM within a couple of clicks following the recommendations listed below. If you must file you have two options.

E-files online tax preparation tools are designed to take the guesswork out of e-filing your taxes. Please complete this form in black ink and use capital letters. Please complete this form in black ink and use capital letters.

For tax purposes options can be classified into three main categories. There are three variants. Our program works to guide you through the complicated filing process with ease helping to prepare your return correctly and if a refund is due put you on your way to receiving itShould a tax question arise we are always here help and are proud to offer qualified online tax support to all.

Opt to tax land andor buildings. E-filing is generally considered safer faster and more convenient but some people cant e-file and must mail their tax returns to the IRS. Use form VAT1614H to apply for permission to opt land or buildings for VAT purposes.

Follow the step-by-step instructions below to design youre vat 5l form. Quick Resolution with 247 Customer Support. Should I opt to tax.

For example puts or calls on individual stocks. Each year you need to decide which filing method is right for you.

Philadelphia Taxes Filing Taxes Tax Forms Tax Advisor

Editable Option To Purchase Real Estate Contract Real Estate Etsy

Tips For Buying Tax Exempt Textbooks Textbook Tips Tax

What Are The Two Options Singapore Companies Have When Filing Their Tax Returns What Is The Difference Between Form C And Fo Tax Return Singapore Filing Taxes

Tax Due Dates Stock Exchange Due Date Tax

Due Dates For Tds Income Tax Return Itr Income Tax Return Tax Return Income Tax

Form 656 Ppv Offer In Compromise Periodic Payment Voucher

You Can File Your Tax Return On Your Own It S Easy Quick And Free When You File With Tax2win On Your Onenote Template Income Tax Preparation Tax Preparation

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

Collective Tax Prep Checklist Tax Prep Health Savings Account

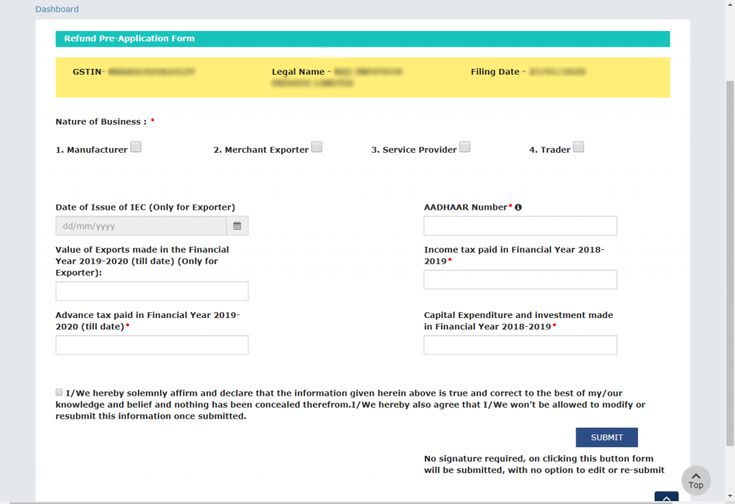

Gst Portal New Feature On Pre Fill An Application Form For Refund Tax Refund Application Form Filing Taxes

Tds Due Dates Due Date Generation Make It Simple

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 100 Count Security Envelopes Small Business Accounting Software Business Accounting Software

Explore Our Example Of First B Notice Form Template Letter Templates Lettering Letter Writing Template

Free Tax Information In 2022 Tax Software Estimated Tax Payments Filing Taxes

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 25 Count Tax Forms Security Envelopes Small Business Accounting Software

Federal Excisetax Form2290 Quarterly Federal Excise Tax Form720 International Fueltax Agreement Report Ifta All These Tax Deadline Filing Taxes Tax

Pin By Tricia Soltesz On Pta Donation Letter Pto Fundraiser Fundraising Letter